Below you will find pages that utilize the taxonomy term “FinTech”

Curated Trades Update: 50% Returns in a Volatile Market

Happy Super Bowl Sunday, everyone.

While you’re waiting for kickoff, I wanted to share a quick update on our flagship feature: Curated Trades.

The market has been extremely volatile over the last couple of weeks. Tech stocks have been decimated, and many portfolios are seeing red. We launched our Curated Trades engine right in the midst of this chaos, so I was curious myself to see how the model would handle the stress test.

Establishing Our Footprint: San Francisco

We stopped by our San Francisco headquarters today in the Union Square district. 🌁

While retailtrader.ai remains a remote-first setup, it is important for us to have a physical footprint here at 447 Sutter St, right alongside other emerging fintech startups.

There is a specific energy in this city—and specifically in this building—that drives innovation. It is good to be close to the action.

The Mission Remains the Same We are 100% bootstrapped and building for the long term. This location gives us a base to connect with the industry while we continue focused development on the signals that matter to you.

The Most Dangerous Thing in Trading Isn't Volatility

The most dangerous thing in trading isn’t volatility. It’s isolation.

Most retail traders fail because they are trying to beat institutional algorithms while sitting alone in a room. They have the charts, but they don’t have the conviction.

At retailtrader.ai, we solved the data problem first. Our neural networks scan the market 24/7 to find high-probability setups (like the $AAPL and $NVDA signals we caught last week).

But data is only half the equation. Execution is the other half.

Welcome to Vibe Trading!

In software, the new paradigm is “Vibe Coding”—AI writes the code, Human verifies the logic.

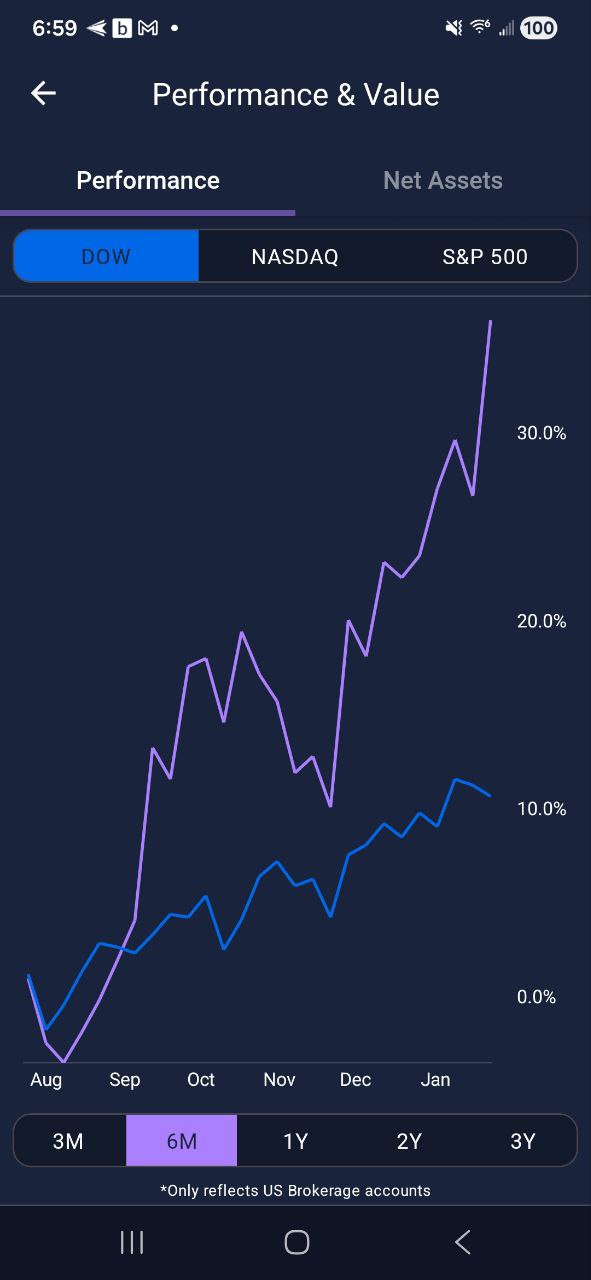

At retailtrader.ai, we applied this exact architecture to retail execution, and the results are in the chart below. 📉📈

THE “PURPLE LINE” (My Personal Portfolio) vs. THE “BLUE LINE” (S&P 500)

While the market chopped sideways this month, my personal account broke out vertically (+40%).

HOW OUR “VIBE” WORKFLOW WORKS:

- The Heavy Lifting (AI): Our engine scans the market overnight and generates precise “Pending Orders” (Entry Price, Stop Loss, and Targets) for the next day.

- The Verifier (Me): I check the signals in the evening. If I like the setup, I place the pending order with my broker.

- The “Anti-Hurry” Advantage: Unlike alert services that demand you act in split seconds, our signals are designed for Pending Orders. You have hours to verify the chart, check the news, and decide—without the FOMO or the rush.

The next day? I don’t watch the screen. The market either triggers the order, or it doesn’t. This is the difference between “working” for your alpha and “verifying” it.

Strategic Update: We Have Acquired retailinvestor.ai

We believe the wall between “Trading” and “Investing” is artificial.

Too often, “long-term investing” is used as an excuse for lack of discipline. But whether you hold a position for 5 minutes or 5 years, the math remains exactly the same.

An investor is simply a trader operating on a longer timeframe. You still need data-driven entries. You still need defined risk. You still need a system.

The Acquisition

To support this vision, we have officially acquired retailinvestor.ai.

A Tale of Two Cities: Market Divergence & The 'Founder Incentive'

It’s been like a “Tale of Two Cities” in the markets recently.

On one hand, you have second-tier tech stocks getting decimated. If you are holding these, you see no hope, and you might be waiting years for them to bounce back—if they ever do.

On the other hand, you have stocks like Alcoa, Restoration Hardware, Occidental Petroleum, and Kratos Defense that have been absolutely flying nonstop. Just look at the Alcoa chart and you’ll see exactly what I mean.

The 'Dumb Money' Narrative is Dead: Why the Fund Manager is an Endangered Species

By Prashant Rao, CEO of retailtrader.ai

For decades, Wall Street has peddled a convenient lie: that investing is too complex for the average person, that market mechanics are a dark art, and that you—the retail investor—need a “professional” to shepherd your wealth.

We founded retailtrader.ai on a single, controversial premise: The traditional fund manager is an outdated concept.

We couldn’t help but notice the headline on CNBC tonight. It wasn’t just a news story; it was a vindication. The reporting confirmed what we have known all along—that the tide has turned.