Below you will find pages that utilize the taxonomy term “AI”

Curated Trades Update: 50% Returns in a Volatile Market

Happy Super Bowl Sunday, everyone.

While you’re waiting for kickoff, I wanted to share a quick update on our flagship feature: Curated Trades.

The market has been extremely volatile over the last couple of weeks. Tech stocks have been decimated, and many portfolios are seeing red. We launched our Curated Trades engine right in the midst of this chaos, so I was curious myself to see how the model would handle the stress test.

Introducing the Execution Desk: Curated Trades & The Pro Plan

Intelligence is nothing without execution.

For the last few months, we have focused on building a best-in-class data engine—decoding market noise using complex neural networks. We proved that the “retail” trader could have access to institutional-grade data.

But data alone doesn’t place the trade.

Today, we are officially opening the Execution Desk at retailtrader.ai.

We are proud to introduce the Pro Plan and our flagship workflow: Curated Trades.

The Problem: Analysis Paralysis

We built this platform for the working professional. You don’t have time to stare at charts for 6 hours a day, and you don’t need more “noise.” You need a managed lifecycle that moves you from raw data to a clear, mathematical edge.

The Ferrari vs. The Tank: Why I Chose 40% Returns Over 95%

The Fork in the Road

This week, we officially launched Curated Trades at retailtrader.ai. During the development process, I faced a major decision regarding our Pro Plan risk profiles.

The data gave us two clear paths:

- The Ferrari: ~95% annualized returns. High speed, high reward, but high-G force (15%+ drawdowns).

- The Tank: ~40% annualized returns. Systematic, steady, and built for the long haul.

Personally, I trade like a Ferrari driver. But most retail traders are working professionals looking for a systematic “Execution Desk” that doesn’t keep them up at night. We chose The Tank.

The Most Dangerous Thing in Trading Isn't Volatility

The most dangerous thing in trading isn’t volatility. It’s isolation.

Most retail traders fail because they are trying to beat institutional algorithms while sitting alone in a room. They have the charts, but they don’t have the conviction.

At retailtrader.ai, we solved the data problem first. Our neural networks scan the market 24/7 to find high-probability setups (like the $AAPL and $NVDA signals we caught last week).

But data is only half the equation. Execution is the other half.

Welcome to Vibe Trading!

In software, the new paradigm is “Vibe Coding”—AI writes the code, Human verifies the logic.

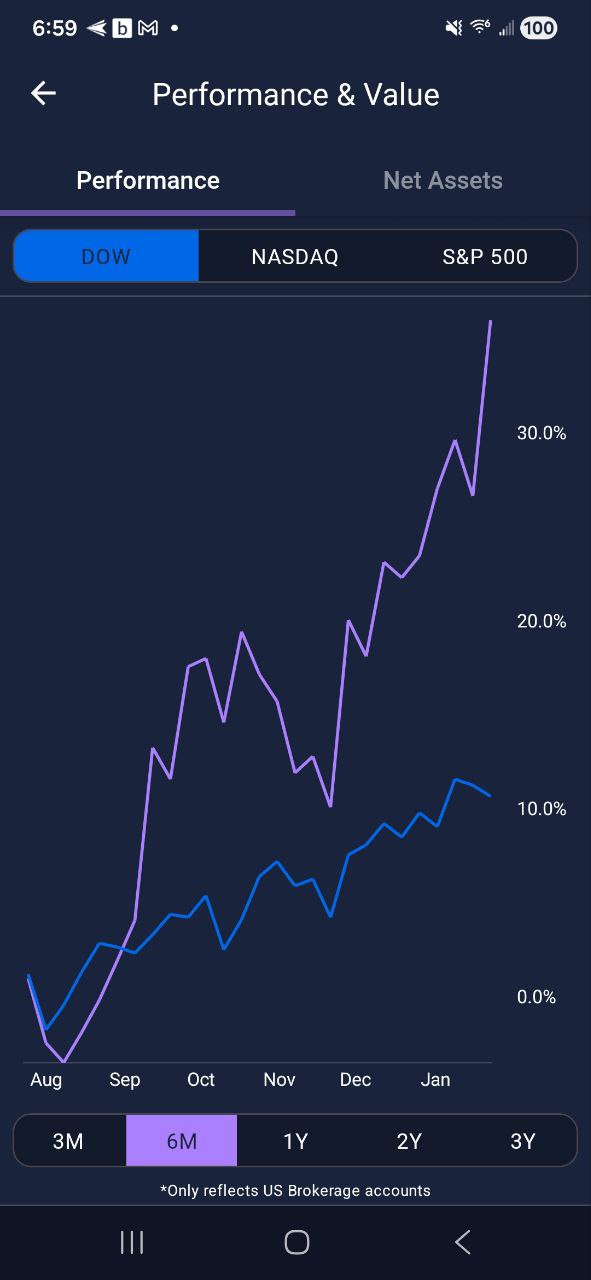

At retailtrader.ai, we applied this exact architecture to retail execution, and the results are in the chart below. 📉📈

THE “PURPLE LINE” (My Personal Portfolio) vs. THE “BLUE LINE” (S&P 500)

While the market chopped sideways this month, my personal account broke out vertically (+40%).

HOW OUR “VIBE” WORKFLOW WORKS:

- The Heavy Lifting (AI): Our engine scans the market overnight and generates precise “Pending Orders” (Entry Price, Stop Loss, and Targets) for the next day.

- The Verifier (Me): I check the signals in the evening. If I like the setup, I place the pending order with my broker.

- The “Anti-Hurry” Advantage: Unlike alert services that demand you act in split seconds, our signals are designed for Pending Orders. You have hours to verify the chart, check the news, and decide—without the FOMO or the rush.

The next day? I don’t watch the screen. The market either triggers the order, or it doesn’t. This is the difference between “working” for your alpha and “verifying” it.

Selectivity vs Volume: Why Selection is the Ultimate Force Multiplier

Selectivity vs Volume: Why Selection is the Ultimate Force Multiplier

In quantitative trading, the validity of a strategy is only as good as its constraints. At retailtrader.ai, we utilize an Exact Parity Simulator that treats our strategy with the same rigor as a professionally managed fund. Our latest results reveal a compelling narrative: algorithmic selection transforms raw market signals into institutional-grade alpha.

Context of Performance

- Out-of-Sample Data: These results represent live data tracked since our launch in Nov 2025, representing ~50 days. While the metrics are subject to short-term compounding due to the short time window, it demonstrates the general efficacy and the positive alpha of the methodology used.

- Normalization: We fully expect these extraordinary figures to normalize as market conditions shift.

- Live Signals: This simulation shows how the system would have performed if you followed the actual live signals delivered to our users since our launch in the real-world environment.

1. Experimental Design: The “Physics” of the Forward-Simulation Test

Most retail systems generate massive mental stress by forcing users to chase nanosecond ticks. We reject that model in favor of First Principles. Our architecture is specifically tailored for a “Fire and Forget” approach: