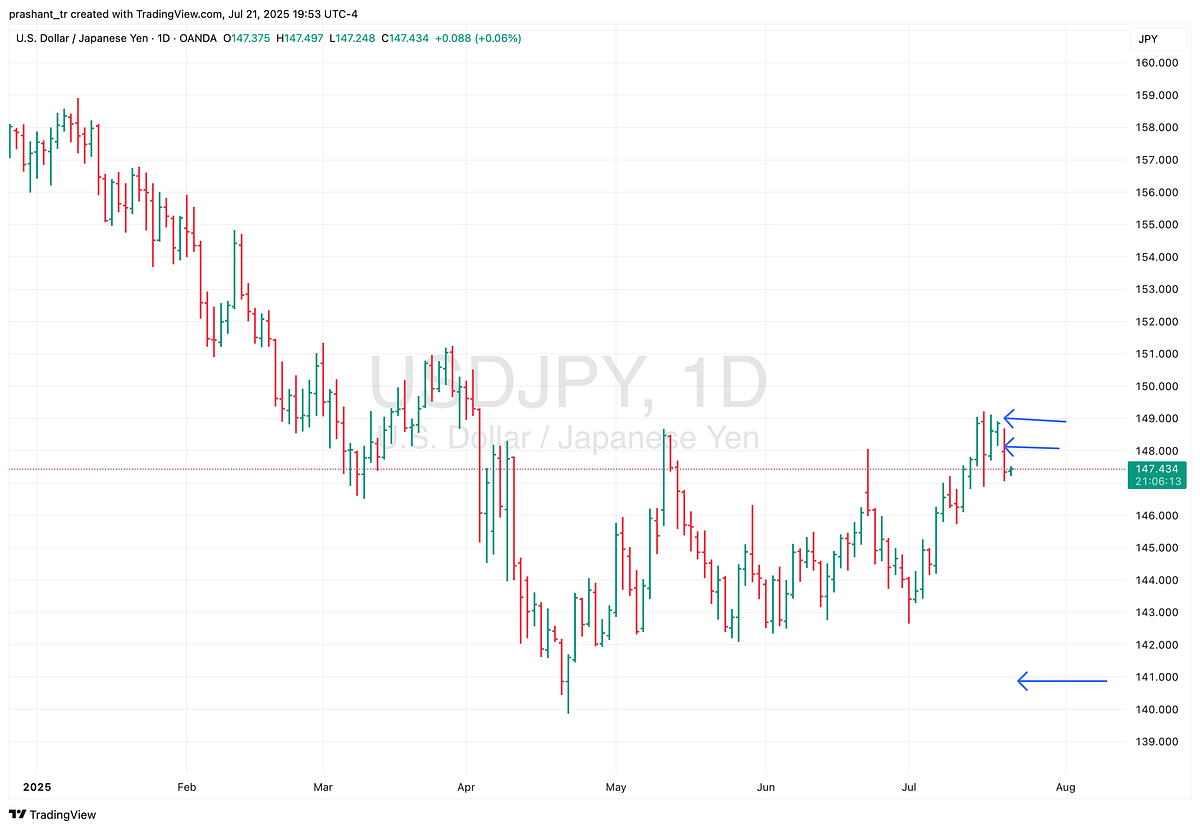

USD/JPY Blow off top with an inside bar

The market is often counterintuitive. For example, if you read my previous article where USD/JPY made two big key reversals and the natural thing for it to do was to go down, it did exactly the opposite.

If you placed your trade right and let the market enter you into the trade, you wouldn’t have been triggered. That’s one of the key elements in execution. It is always to let the market trigger your trade. That provides an extra degree of confidence. Sure, it would go reverse and the other way, but you’ve already increased the probability of your trade by putting in that SELL STOP or BUY STOP.

Last week, USD/JPY had an interesting move. If you look at the chart, it appears like it’s about to race up. It looks like a classic double bottom with key reversal, except it’s probably not.

We love setups like these, because this allows us to put in a double sided trade. Depending on which side the market decides to race, you are going to get in and make a very good profit. The inside bar coil on Friday indicated that a huge volatile move is about to happen. And that’s exactly what happened. We had a big drop in USD/JPY. You could take some profits off the table here, but it looks very likely it’s going much further down.

Now, that’s what a high probability setup looks like.