Saving Yourself From a Trading Diaster

Few days ago, I posted a probability paper that talked about how an execution filter can lift your gains by not triggering unexpected trades. Today is a great example of how putting in an additional execution criteria and pre-defined risk parameters can save you from a disaster.

Blue/Red line is the buy/sell stop. Yellow is stop loss. The trades never triggered. The best trade is one that never triggers :).

Improving Risk Management in Trading

Risk management is a critical piece of any trading strategy. Welcome your comments.

https://drive.google.com/file/d/16yAsinYyTJyzioBQ1TGf3FyRRvVSFbkQ/view?usp=drive_link

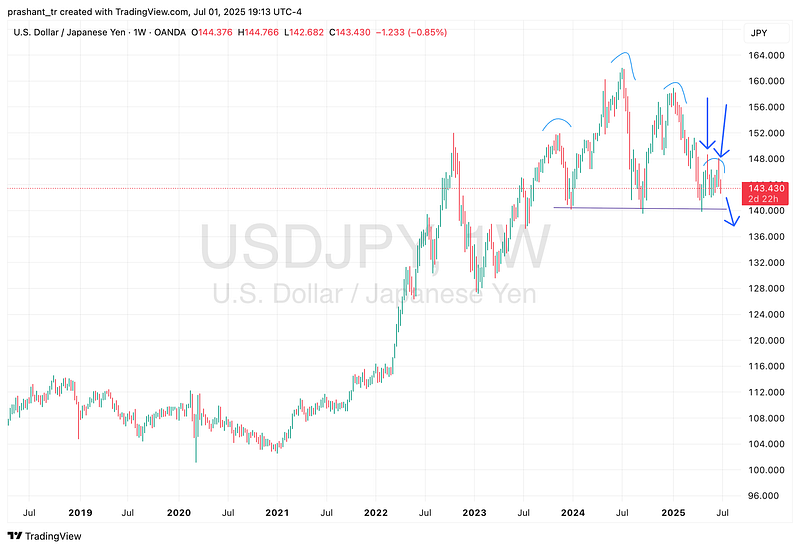

USD/JPY Blow off top with an inside bar

The market is often counterintuitive. For example, if you read my previous article where USD/JPY made two big key reversals and the natural thing for it to do was to go down, it did exactly the opposite.

If you placed your trade right and let the market enter you into the trade, you wouldn’t have been triggered. That’s one of the key elements in execution. It is always to let the market trigger your trade. That provides an extra degree of confidence. Sure, it would go reverse and the other way, but you’ve already increased the probability of your trade by putting in that SELL STOP or BUY STOP.

USD/CAD likely to continue lower

Today, we appear to have made what could potentially form a double top on USD/CAD. This pair has been moving lower in the form of a descending triangle more recently. The reversal today after mildly breaking through the highlighted line seems to indicate that the move up may be over.

If you are interested in getting into the trade, use the entry, stop loss and take profits below. I’m sure you can guess which one is which. 😊

USD/CAD moving lower

USD/CAD appears to have started continuing in it’s earlier trajectory, which is downward. Let’s week, similar to USD/JPY we had a blow off top with an inside bar pointing downward. A good trade was to enter below the low of the inside bar. The move is likely to continue to the level indicated.

EUR/USD and AUD/USD: Low risk entry point

Today, we had a highly volatile trading day in the Forex and Equities markets. Volatility is the norm in all markets, but today was extraordinarily volatile.

The market always does what it was going to do, regardless of what comes out on the news. More often that not, what comes out in the news is well known information. For example, the fact that Trump was planning on firing Powell is not new news. But there was a panic.

USD/JPY headed lower

USD/JPY seems to be forming a major double top, head and shoulders pattern. The two recent key reversals forming a smaller double top on the right indicate a possibility of a steep move to the downside

Follow on https://x.com/retailtraderAI

Looking for specifics of the trade? Contact us on https://retailtrader.ai/

NZD/CAD and EUR/CAD about to breakout

NZD/CAD appears to have made breaking out in a fairly significant way. It appears to be forming a long term double bottom with a large key reversal at the bottom. Followed by that, we have an inverted head and shoulder formation with another key reversal indicating an upside move.

EUR/CAD similarly appears to be forming a huge multi year double bottom. In recent times, you can see another large reverse head and shoulder formation with a possibility of an imminent breakout.

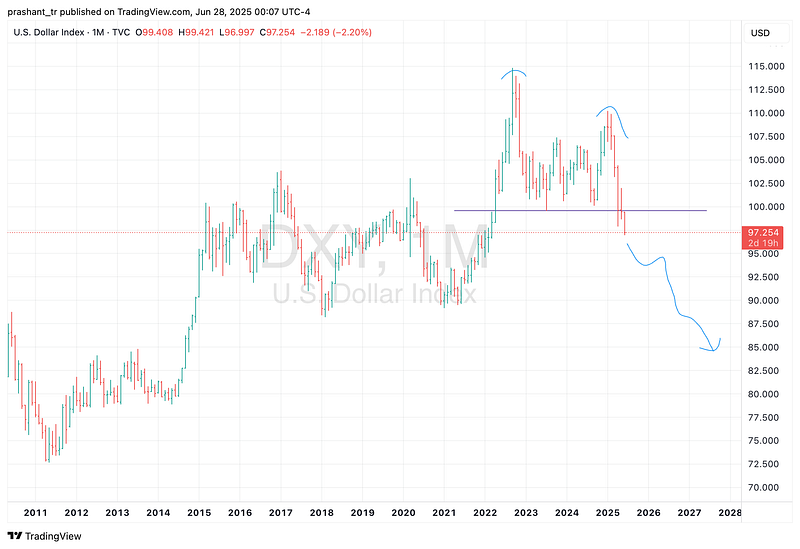

Critical Moment in Forex Markets

We appear to be at a critical point in the Forex Market, particularly for USD pairs. USD had regained it’s strength since the 2008 downturn, but now, we appear to be at a point where we could see a continuous downward trend in USD for many years to come.

Check out the Dollar Index DXY

The Dollar Index formed a major double top on the monthly and crossed the neckline. Followed by that we had an inside month bar, pointing to the bottom with a breakdown this month. What this seems to indicate is that we’re going to see a breakdown in the dollar for a very extended period of time.

Welcome to retailtrader.ai

Did you know that some of the smartest people are the most likely to lose the maximum money in the markets?

Doctors, lawyers, scientists and engineers are the top losers in the market.

In general, any individual trading in the market has a 95% chance of losing all their money over time. With leveraged trading such as Futures or Forex, that number an go up to as high as 95%. It wouldn’t be surprising if ithat number is actually 99%.