Strategic Update: We Have Acquired retailinvestor.ai

We believe the wall between “Trading” and “Investing” is artificial.

Too often, “long-term investing” is used as an excuse for lack of discipline. But whether you hold a position for 5 minutes or 5 years, the math remains exactly the same.

An investor is simply a trader operating on a longer timeframe. You still need data-driven entries. You still need defined risk. You still need a system.

The Acquisition

To support this vision, we have officially acquired retailinvestor.ai.

A Tale of Two Cities: Market Divergence & The 'Founder Incentive'

It’s been like a “Tale of Two Cities” in the markets recently.

On one hand, you have second-tier tech stocks getting decimated. If you are holding these, you see no hope, and you might be waiting years for them to bounce back—if they ever do.

On the other hand, you have stocks like Alcoa, Restoration Hardware, Occidental Petroleum, and Kratos Defense that have been absolutely flying nonstop. Just look at the Alcoa chart and you’ll see exactly what I mean.

The Difference Between Tracking the Market and Beating It: A 6-Month Update

I posted a snapshot of my portfolio performance 60 days ago. Since then, the market (Orange line) has ticked up steadily. But my personal portfolio utilizing retailtrader.ai signals (Purple line) has widened the gap significantly.

Figure 1: Performance comparison showing S&P 500 vs. My Portfolio over the last 6 months.

Figure 1: Performance comparison showing S&P 500 vs. My Portfolio over the last 6 months.

We are now looking at a +27% return over the last 6 months, compared to the market’s ~11%.

Post Venezuela and Oil Stocks

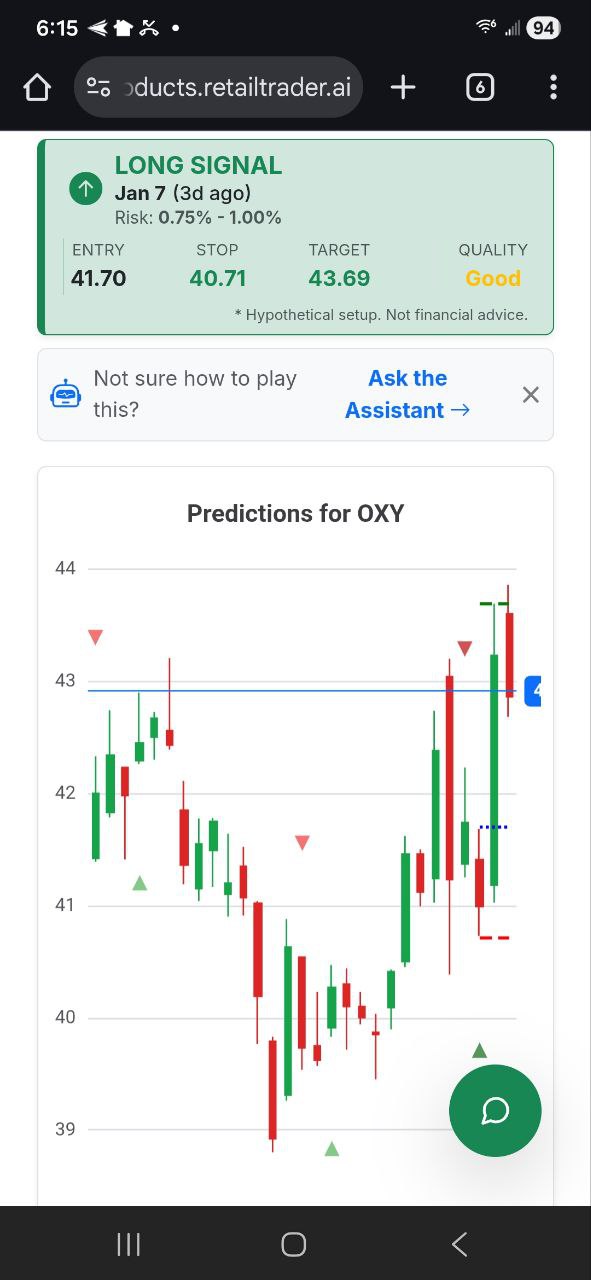

Our most recent signal for Occidental Petroleum (ticker: OXY) post Venezuela.

Why Real-Time Prediction Fails Retail Traders (Plus: $RH and My Bull Case for $OXY)

It’s a rainy Sunday here in the Bay Area, and I wanted to sit down to address a few frequent questions from our users, give you a sneak peek at a major feature coming to retailtrader.ai, and talk about where the smart money is moving in the energy sector.

You can watch the full update video below, or read on for the breakdown.

Why We Don’t Do “Real-Time” Prediction

One of the most common questions I get is: “Why doesn’t retailtrader.ai offer real-time prediction?”

The 'Dumb Money' Narrative is Dead: Why the Fund Manager is an Endangered Species

By Prashant Rao, CEO of retailtrader.ai

For decades, Wall Street has peddled a convenient lie: that investing is too complex for the average person, that market mechanics are a dark art, and that you—the retail investor—need a “professional” to shepherd your wealth.

We founded retailtrader.ai on a single, controversial premise: The traditional fund manager is an outdated concept.

We couldn’t help but notice the headline on CNBC tonight. It wasn’t just a news story; it was a vindication. The reporting confirmed what we have known all along—that the tide has turned.

Selectivity vs Volume: Why Selection is the Ultimate Force Multiplier

Selectivity vs Volume: Why Selection is the Ultimate Force Multiplier

In quantitative trading, the validity of a strategy is only as good as its constraints. At retailtrader.ai, we utilize an Exact Parity Simulator that treats our strategy with the same rigor as a professionally managed fund. Our latest results reveal a compelling narrative: algorithmic selection transforms raw market signals into institutional-grade alpha.

Context of Performance

- Out-of-Sample Data: These results represent live data tracked since our launch in Nov 2025, representing ~50 days. While the metrics are subject to short-term compounding due to the short time window, it demonstrates the general efficacy and the positive alpha of the methodology used.

- Normalization: We fully expect these extraordinary figures to normalize as market conditions shift.

- Live Signals: This simulation shows how the system would have performed if you followed the actual live signals delivered to our users since our launch in the real-world environment.

1. Experimental Design: The “Physics” of the Forward-Simulation Test

Most retail systems generate massive mental stress by forcing users to chase nanosecond ticks. We reject that model in favor of First Principles. Our architecture is specifically tailored for a “Fire and Forget” approach:

The Architecture of Alpha: Building a Hybrid AI Signal Engine

Delayed Quotes and Risk Calculators

We just upgraded the retailtrader.ai experience. ⚡

Based on recent user feedback, we’ve pushed a significant update to help you filter noise and manage risk.

Here is what’s new:

15-Min Delayed Quotes: Added to watchlists to provide the perfect middle ground for market awareness without the noise of real-time ticks. Position Size Calculator: A built-in tool for stocks so you no longer have to do mental math on entry sizes. Setup Quality Ratings: Now you can filter by “High” or “Good” quality to focus on the best opportunities. Zero High-Risk Signals: We have permanently removed the lowest probability setups from our signals.

AI Assistant and Watchlists Launch

We are excited to announce significant enhancements to retailtrader.ai, designed to give individual investors clearer insights and instant support. We’ve been listening to feedback and have deployed a suite of new features to streamline your trading workflow.

What’s New?

🤖 AI Knowledge Assistant: We’ve launched a RAG-based AI chatbot to instantly answer your questions about our signals, platform features, or trading methodology.

📋 Custom Watchlists: You can now create, rename, and manage multiple watchlists to manually track different sectors or strategies separately.