The Billionaire Paradox: If Your Trading Strategy Works, Why Sell It?

I was scrolling through one of the algorithmic trading groups on Reddit this morning when I stopped on a post that I think every retail trader has thought about at least once.

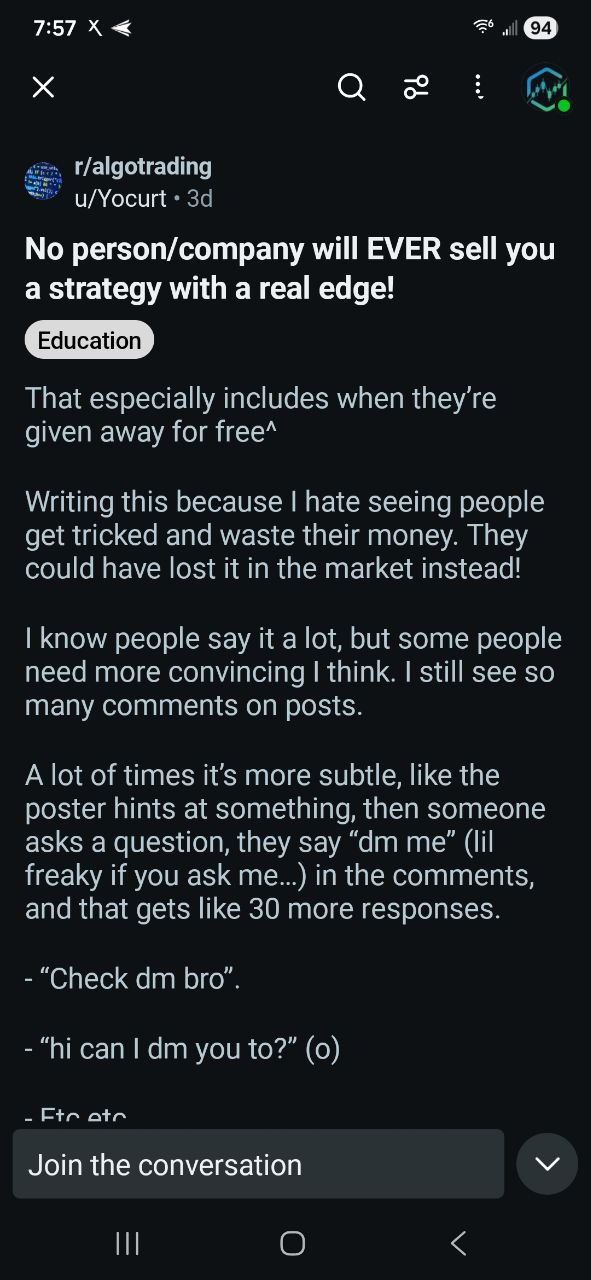

The title read: “No person/company will EVER sell you a strategy with a real edge!”

(Context: A skeptical trader arguing that if a strategy made money, the owner would keep it secret.)

(Context: A skeptical trader arguing that if a strategy made money, the owner would keep it secret.)

I want to start by saying: This is a very valid question.

This space is filled with “Lamborghini Gurus” selling courses on how to get rich quick. The OP (Original Poster) is right to be skeptical. In fact, skepticism is a healthy survival mechanism in finance. When you see someone selling a “money printer,” your first instinct should be doubt.

But there is a fundamental misunderstanding in this logic regarding human nature—and specifically, the nature of Builders.

The argument rests on a single assumption: “If you had a way to make money, you would just sit in a dark room, keep it a secret, and do nothing else until you were a trillionaire.”

Here is why that view is flawed, and why we built retailtrader.ai to be an open platform.

1. The Billionaire Paradox

If the only reason to work was to accumulate “enough” money, the world would look very different.

- Why does Warren Buffett still go to the office every day at 93 years old?

- Why do tech founders who have already exited for millions start new companies?

- Why do Michelin-star chefs write cookbooks revealing their exact recipes?

By the Reddit logic, a chef should never share their recipes, or they lose their “edge.”

The truth is, for high performers, money is just a scorecard. The real driver is the Craft.

Builders love to build. Masters love to teach. The joy isn’t just in the hoarding of wealth; it’s in the execution of the work. If Buffett sat on a beach for the last 30 years, he wouldn’t be happier—he would be bored.

2. The Revenue Reality (95:5)

Let me be transparent about my own situation.

I am not a billionaire. But I do track my metrics religiously. When I look at my personal revenue split, the ratio of income derived from Trading P&L versus Subscription Revenue is roughly 95:5.

For every dollar I make from a subscriber like you, I make $19 from the market using the exact same tools.

If I were doing this solely for the money, the “Subscription Business” would be a bad allocation of my time. It takes engineering, support, content, and server costs. It would be far more “profitable” (in terms of effort) to just shut down the site and trade.

But I don’t shut it down. Why?

Because the 5% represents something the 95% cannot give me: Purpose.

Building this platform keeps me sharp. It forces me to articulate my logic. And frankly, it’s fun to see other people win using the tools I built.

3. The Mentor Who Didn’t Need My Tuition

Years ago, I learned to trade from a mentor who was already a multimillionaire.

Financially speaking, it made zero sense for him to spend hours with me looking at charts. He didn’t need my money. He could have just traded his own account and spent the rest of his day on a yacht.

So, why did he do it?

Because he took immense pride in his mastery. He loved the markets, and he loved seeing that “lightbulb” moment when I finally understood a concept. He understood that knowledge is one of the few assets that grows when you share it.

If he had subscribed to the idea that “You must never share your edge,” I wouldn’t be here today.

4. The “Scale” Reality (Why Sharing Doesn’t Break It)

There is also a technical reason why selling a strategy doesn’t “ruin” the edge, specifically for what we do at retailtrader.ai.

Hedge Funds manage billions of dollars. They cannot trade certain strategies because they are too big. If they try to enter a small, structural inefficiency, their sheer size moves the market and destroys the profit.

We focus on those exact inefficiencies.

- Our Concept Trades (the Analyst engine) identify structural setups that are often too niche for BlackRock, but perfect for you.

- Our Curated Trades (the Strategist engine) execute these setups with precision.

A thousand retail traders using this GPS won’t break the market. We are swimming in the pockets where the whales can’t fit. Sharing the map doesn’t destroy the road.

The Transition: From Employee to CEO

I didn’t build this platform to “sell a secret.” I built it because I was obsessed with the capital markets, but I hated the “Hustle Culture” of staring at screens all day.

I wanted to move from being a Hustling Employee of the market (reacting to noise) to a Strategic CEO of my portfolio (approving plans).

Once I built the engine and saw it working for my own capital, I had two choices:

- The Scarcity Mindset: Hoard it and stay isolated.

- The Builder Mindset: Share it, improve it with data from the community, and build a business I’m proud of.

I chose the latter.

So, to the Reddit skeptic: I hear you. Keep your guard up against the gurus. But don’t let cynicism blind you to the fact that some people just love the game, and they want to bring others along for the ride.

Stop trading like an employee. Start trading like a CEO.

Disclaimer: Past performance is not indicative of future results. Trading involves risk.