Banned for Efficiency: The Tragedy of the 'Hustle' Cult

Founder

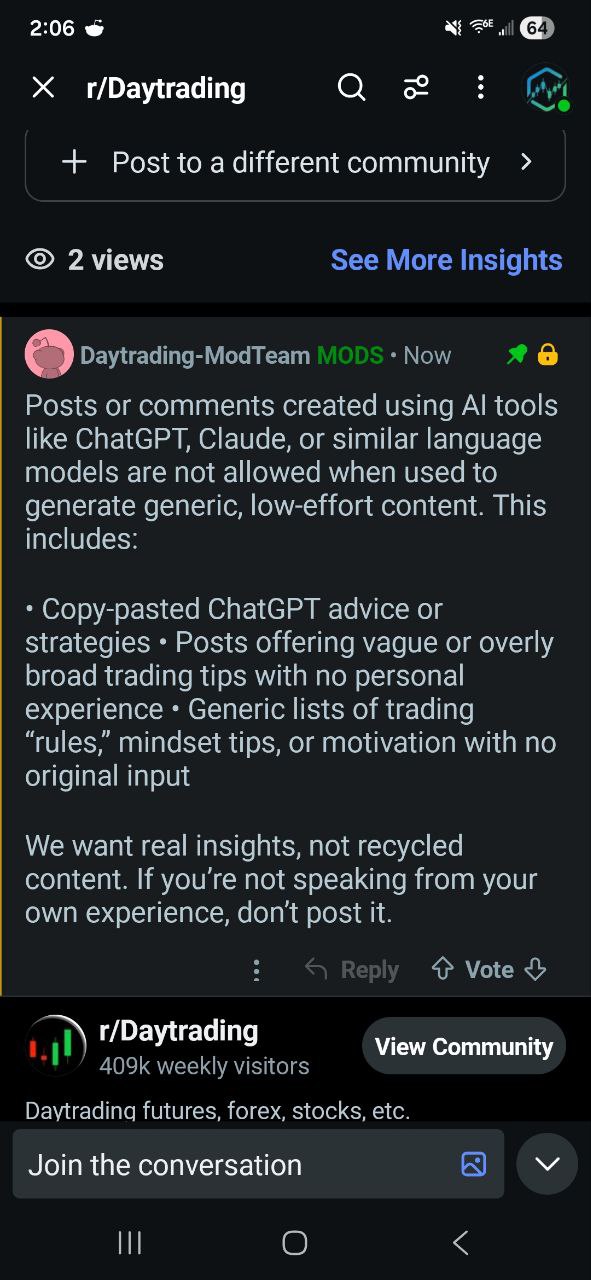

I just got permanently banned from one of the largest trading communities on the internet.

My offense? I wrote a post arguing that “Hustle Culture” destroys trading accounts, and I admitted to using AI to refine my writing.

The moderators labeled it “Low Effort.”

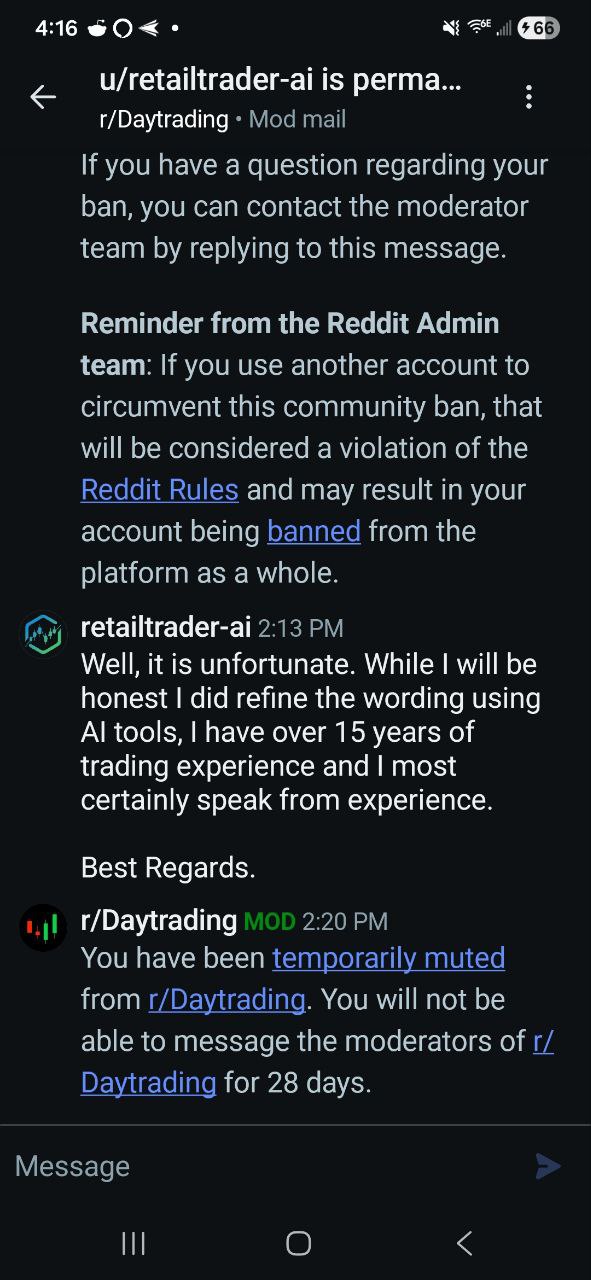

Then, to ensure I couldn’t defend myself, they muted me.

They acted as Judge, Jury, and Executioner. They didn’t want a debate about efficiency vs. manual labor. They wanted silence.

From Community to Cult

Most trading forums start with good intentions: beginners helping beginners navigate the markets.

But over time, they devolve into cults. They establish a set of “Holy Laws” that cannot be questioned:

- Thou shall stare at charts for 8 hours.

- Thou shall execute manually.

- Thou shall suffer for your profits.

When I said, “I built a Neural Network to watch the charts so I can do nothing,” I wasn’t just breaking a rule. I was committing heresy.

To the cult of the “Grind,” efficiency looks like cheating. If you aren’t suffering, you don’t belong.

The Cost of Silence (The Real Tragedy)

The most painful part of this wasn’t the ban itself. It was what happened seconds later.

Right after I was muted—unable to speak or reply—a new post appeared in the “New” feed.

A young trader posted that they had just lost everything. They had blown their account day trading manually. They were desperate, emotional, and asking for help.

I built retailtrader.ai specifically for that person.

I wanted to tell them:

- “It’s not your fault; manual trading is a rigged game.”

- “You failed because you were fighting math with emotion.”

- “There is a way to automate your risk so this never happens again.”

But I couldn’t. I was silenced by the very people claiming to “protect” the community.

Why 90% Fail

We know the statistic: 90% of retail traders fail.

I believe they fail because they are trapped in this echo chamber. The “Gatekeepers” are blocking the life rafts (automation/risk engines) while the ship sinks, telling everyone to just “bail water harder.”

The market is an indifferent executioner. It does not care how hard you worked. It only cares if you are on the right side of the trade.

The Choice

You can stay in the crowded room with the “Hustlers,” competing to see who can suffer the most while blowing up accounts.

Or you can step outside, build a system, and let the machines do the heavy lifting.

Efficiency isn’t laziness. It is the only edge left.